U.S. Defense Stocks Up

Year‑to‑Date Leaders and What’s Fueling Their Rally

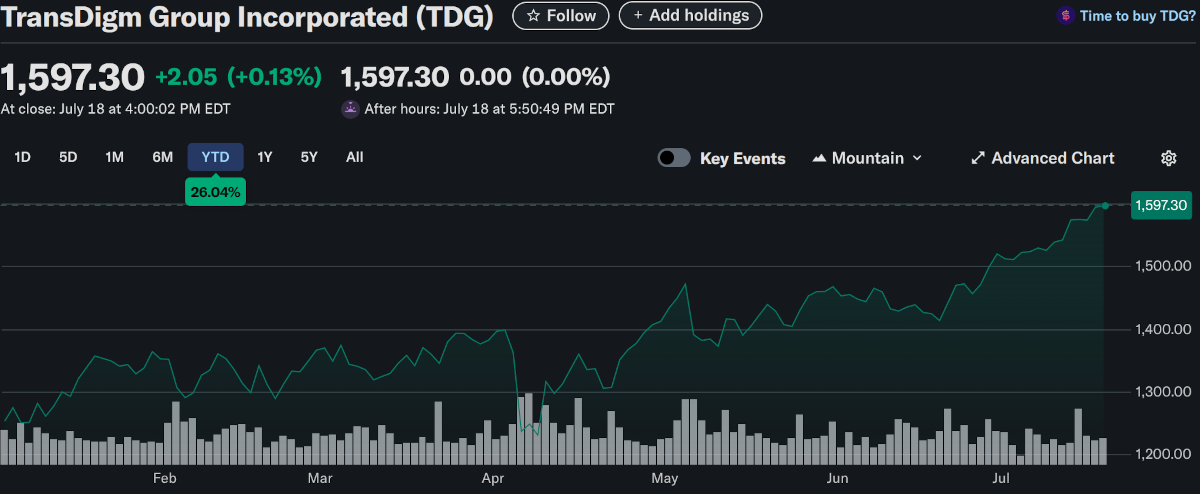

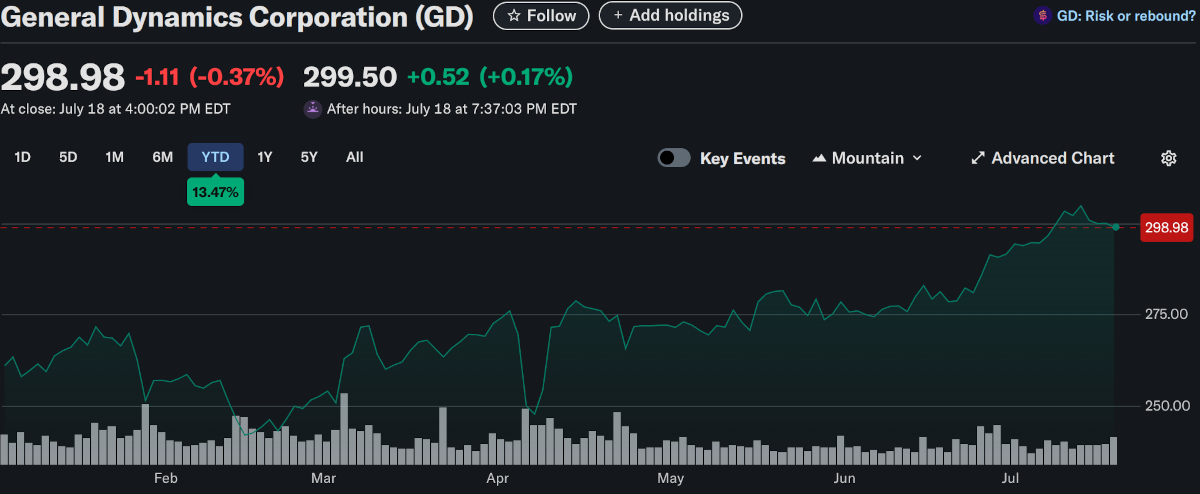

So far the first half of 2025 has been a blockbuster for U.S. defense stocks. Leading the charge (year-to-date): Palantir is up a stunning 102.99%, GE Aerospace is up 57.85%, RTX is up 30.92%, Boeing is up 29.57%, Honeywell is up 4.71%, TransDigm is up 26.04%, General Dynamics is up 13.47%, Northrop Grumman is up 10.60%, and L3Harris is up 25.91%. Old faithful Lockheed Martin did stumble though, down -4.5%.

Increased Military Spending

The FY 2025 National Defense Authorization Act (NDAA) authorized $895.2 billion in national‑defense budget authority—roughly a 1% increase from FY 2024—with $849.9 billion earmarked for the Department of Defense (DoD) and $33.3 billion for Department of Energy national‑security initiatives. With the DoD’s $849.8 billion budget request already approved, contractors are positioned for a wave of new aerospace, shipbuilding, and munitions contracts set to bolster their top‑line forecasts.

Then came President Trump’s “Big Beautiful Bill,” which adds $150 billion in supplemental defense funding, extending through FY 2029 and propelling total U.S. defense outlays beyond the $1 trillion mark.

Geopolitical Tensions

Russia and Ukraine are still tangoing, China’s giving Taiwan the side‑eye, and the Middle East is never dull. The FY 2025 NDAA authorizes up to $300 million for Taiwan’s defense, supporting various military capabilities. Concurrently, the Act allocates $500 million for U.S.–Israel missile defense programs, including systems like Iron Dome, David’s Sling, and Arrow-3. At the NATO summit in The Hague, member nations committed to increasing defense spending to 5% of GDP by 2035, with 3.5% dedicated to core military needs and 1.5% to broader security infrastructure, surpassing the previous 2% target. These developments contribute to the momentum in defense sector investments.

Stable Contracts & Innovation

Multi‑year deals are the backbone here. Raytheon has secured a $279.2 million cost-plus-fixed-fee contract from the U.S. Army to provide functional management support for its Land-Based Phalanx Weapon System (LPWS), extending through July 7, 2030. This contract ensures a steady revenue stream for Raytheon.

The DoD has also awarded $200 million contracts to leading AI firms, including OpenAI, Google, Anthropic, and Elon Musk's xAI. These contracts aim to enhance the DoD's use of advanced AI capabilities and develop 'agentic' AI workflows to address national security challenges. OpenAI's contract focuses on developing AI tools for administrative and cyber-defense applications, underscoring the growing importance of innovation alongside traditional hardware in defense strategies.

Palantir is a U.S. software company specialising in data analytics and AI solutions, primarily serving military and intelligence agencies. It secured a $480 million contract with the U.S. Army for the Maven Smart System, an AI-powered software for military applications. Additionally, over 54% of its revenue comes from government activities, including defense, which aligns with its business model that's heavily reliant on government contracts.

GE Aerospace manufactures engines such as the F110 for F‑15 and F‑16 fighters and the F404/F414 for F/A‑18 aircraft, underscoring its significant role in military propulsion.

RTX is a major global aerospace and defense company. It provides missile systems, radar, aircraft engines, and avionics through its business segments, including Collins Aerospace and Raytheon Missiles & Defense.

Boeing is well-known for producing both commercial and military aircraft. Its defense portfolio includes systems like the F-15 fighter jet, F/A-18 Super Hornet, and P-8 Poseidon maritime patrol aircraft.

Honeywell is a diversified company with a strong presence in defense. It supplies auxiliary power units, environmental control systems, avionics, sensors, and defense electronics.

As a leading U.S. defense contractor, Lockheed Martin manufactures fighter jets like the F-35, along with missiles and advanced defense systems. A high percentage of its revenue comes from government contracts.

TransDigm supplies critical aircraft components, such as data and power management systems, for both commercial and military aircraft.

General Dynamics is involved in producing combat vehicles, ships, and aerospace systems, including notable examples like the Abrams tank and Virginia-class submarines.

Northrop Grumman specialises in aircraft, spacecraft, and advanced electronics, including the B-21 Raider bomber and missile defense systems.

L3Harris provides communication systems, electronic warfare, and space technologies for both defense and commercial markets.